Whole Life Insurance Companies

We ranked the top life insurers in our review to find you the best whole life insurance policies for 2020 highlighting the important features to help you ask the right questions when shopping for life insurance and make your best choice.

Whole life insurance companies. Best ratings of an a or better. They sell whole life policies. Not every life insurance company will make for a perfect fit for each individual so please review this list and contact us to discuss further options that may make sense for your own unique. These life insurance companies sell whole life policies and underwrite those policies.

Lets not waste any time. Best and other rating agencies to make sure it will be able to pay your beneficiaries claim when you pass away. Most life insurance policies that focus on smaller death benefits such as a 25000 whole life insurance policy are usually going to be what are called final expense or burial insurance policies. Known for insuring children with 5000 to 50000.

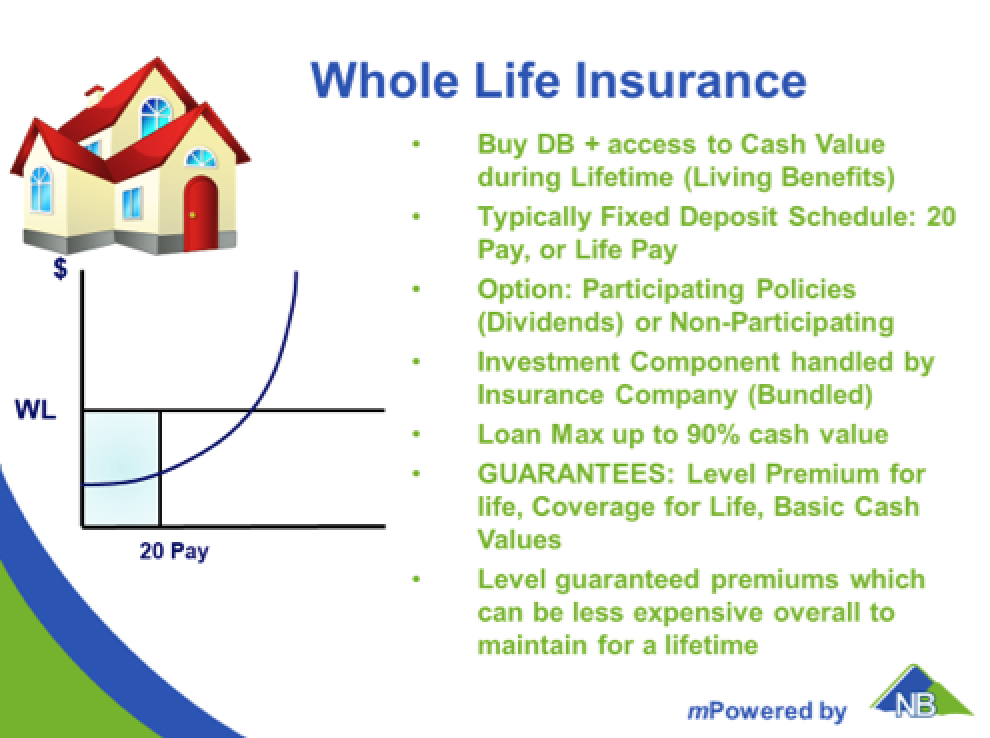

This top 10 list of whole life insurance companies have the ability to pay out dividends have a long history within the life insurance industry as well as have high am. Best whole life insurance companies these 5 insurers stand out for their flexible policies riders and track record for paying out dividends. Its life insurance products are term life whole life and universal life. Life insurance companies that offered whole life policies with dividends and living benefits were considered as part of our evaluation.

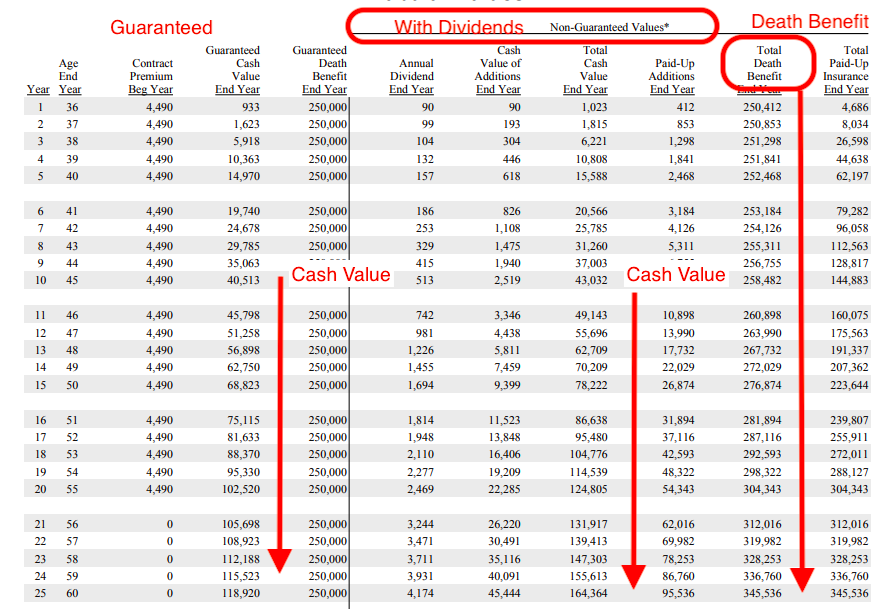

1 massmutual 2 foresters 3 penn mutual 4 new york life 5 guardian life 6 one america 7 ohio national. Whole life insurance is a permanent policy that offers lifelong protection and builds cash value over time. These tools help you calculate your life expectancy how much coverage you might need and more. Our top 10 whole life insurance companies share five characteristics.

Katia iervasi updated apr 27 2020. Company whole life insurance options. If youre new to whole life insurance pacific life has dozens of easy to use financial calculators to help you get started. They are financially reliable.

On the surface life insurance sounds like an easy concept to grasp you pay an insurance company a monthly or annual premium and upon your death the company pays. Retail individual life insurance sales survey for 2019. Final expense life insurance policies are usually reserved for folks over the age of 50 although some companies offer policies at age 45. All of these provide crucial insights when shopping around for life insurance and its a shame that not many other providers offered these resources.

Our top whole life providers have top ratings from am. Though its the simplest permanent policy on offer these five insurers have enhanced their. Each of the companies from the previous list has an explanation as to why we picked them so make sure you read all of the. Top 7 whole life insurance companies for cash value.