Relevant Life Cover

Conditions have to be met to count as relevant life policy and both employees and directors can take out relevant life cover.

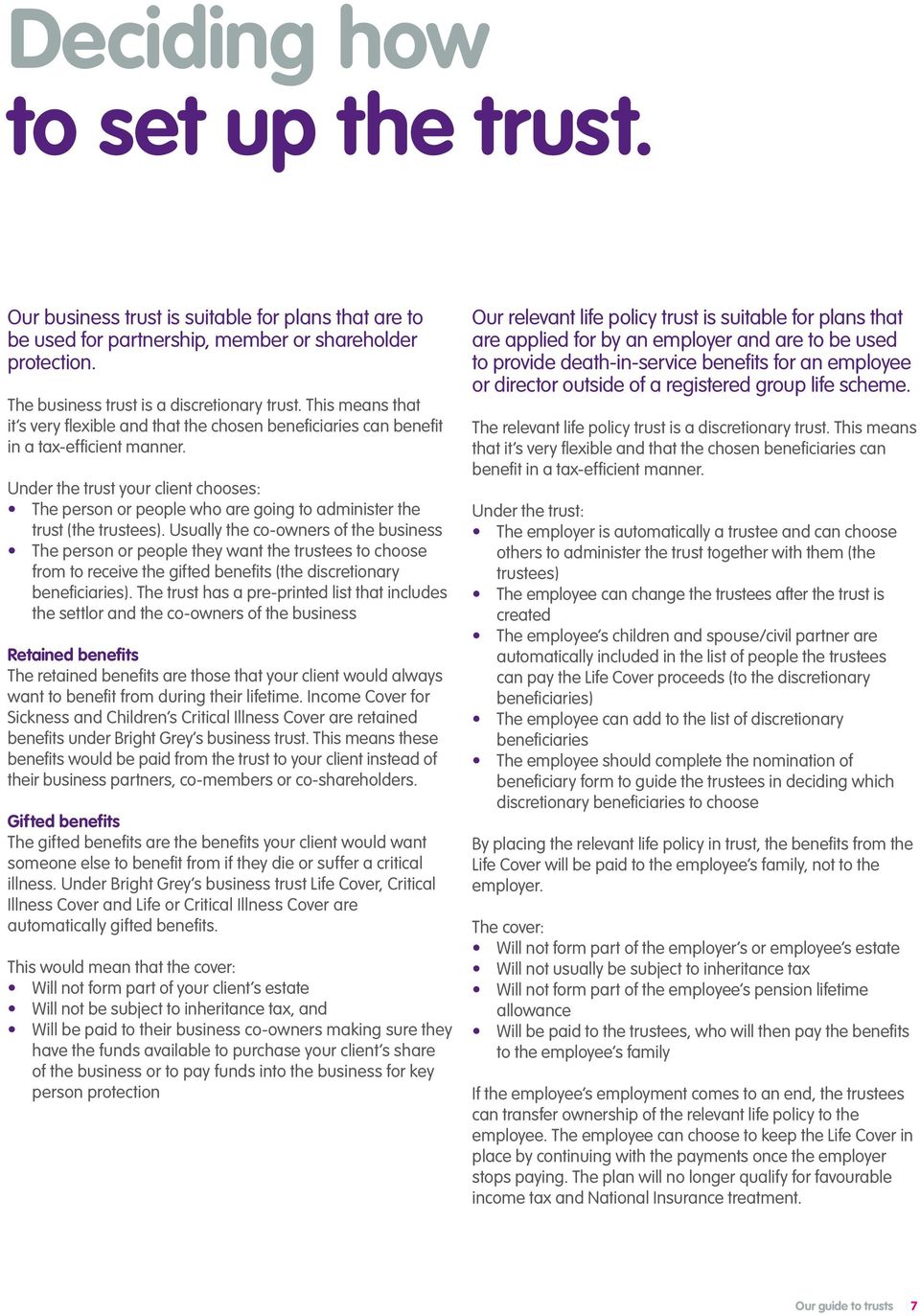

Relevant life cover. They are taken out and paid for by the employer. This is because group life schemes count towards the annual pension lifetime allowance which is 1073100 in the 20192020 tax year. Who is allowed to have one. With relevant life cover the premiums are paid by the company and so are entitled to relief from corporation tax.

An employer may want to opt for relevant life cover if there. For a basic rate taxpayer the. Relevant life cover is also beneficial for high earners as an alternative to joining a group life scheme. A relevant life plan is a life insurance plan available to employers to provide an individual death in service benefit for their employees.

It is covered by legislation that means premiums paid through the company are viewed by hmrc as business expenses and therefore. So is relevant life cover tax deductible. But conditions do have to be met in accordance with hmrc. Underwriting and claims.

The business can be a limited company a partnership a charity or a sole trader. Any payouts under a group life scheme would fall under the allowance risking a hefty tax bill when they access their pension so instead a high earner. Any employee of a business including directors. Use our relevant life calculator see how much you could save.

However providers have been able to adapt it for limited company contractors operating on their own as a oneman limited company. Time to put life cover on expenses. Relevant life plans are similar to most other types of life cover except they aim to provide a tax efficient benefit provided by an employer for an employee. Its designed to pay a lump sum to the employees family if the employee dies when employed while the plan is.

This means that for a higher rate taxpayer the company director can save 49 per cent by paying for their personal life insurance via a relevant life plan. Relevant life insurance is a form of cover originally designed for companies to provide death in service policies for their employees. However we cannot cover sole traders or equity. Relevant life plans provide life cover for the benefit of employees and directors dependants paid through a discretionary trust.

The proceeds go to the employees family or financial dependants. Relevant life plan. So this is ideal for company owners directors or specific employees. Its a tax efficient life insurance policy set up by the employer and pays out a tax free lump sum on the death or diagnosis of a terminal illness of the person insured.

Relevant life cover rlc allows employers to offer a death in service benefit to their employees. Not only that the company will not have to pay the national insurance either.