Mlc Income Protection

Mlcs income protection policy offers a monthly benefit payment to replace up to 75 per cent of your income if you are unable to work due to illness or injury.

Mlc income protection. Mlc income protection income insurance. Your ability to earn an income is one of your greatest assets so it makes sense to protect it. Find my customer number. The maximum benefit available is 30000 for all occupations or 60000 for professional occupations such as surgeons accountants and solicitors.

Potential to grow their fund balance for later in retirement and. A combination of death and total and permanent. How it works you can usually apply for cover of up to 75 of your earnings for a maximum time period. Certainty of knowing their income in retirement is protected.

For business owners this is income after business expenses which can be protected as well but before tax. By providing you with a monthly payment income protection allows you to focus on your recovery. Your client can choose the type of protection that best suits their retirement plan. Choice of when they start receiving their income once theyve retired.

Mlc life insurance provides life cover to suit you your family or business. Protect your clients income for 10 or 20 years or for life and give them the. You can enjoy quality insurance benefits with mlc lifestage insurance our default option. Mlc masterkey investment protection is available to your client who are 50 or older and has an mlc masterkey super pension fundamentals account with eligible mlc horizon and mlc index plus investment options.

This can help cover your living expenses such as your mortgage school fees and car repayments. Mlc limited is a part of the nippon life insurance group and not part of the nab group of companies. Potential to increase their income payments. You may also be able to have an additional amount paid as contributions into your.

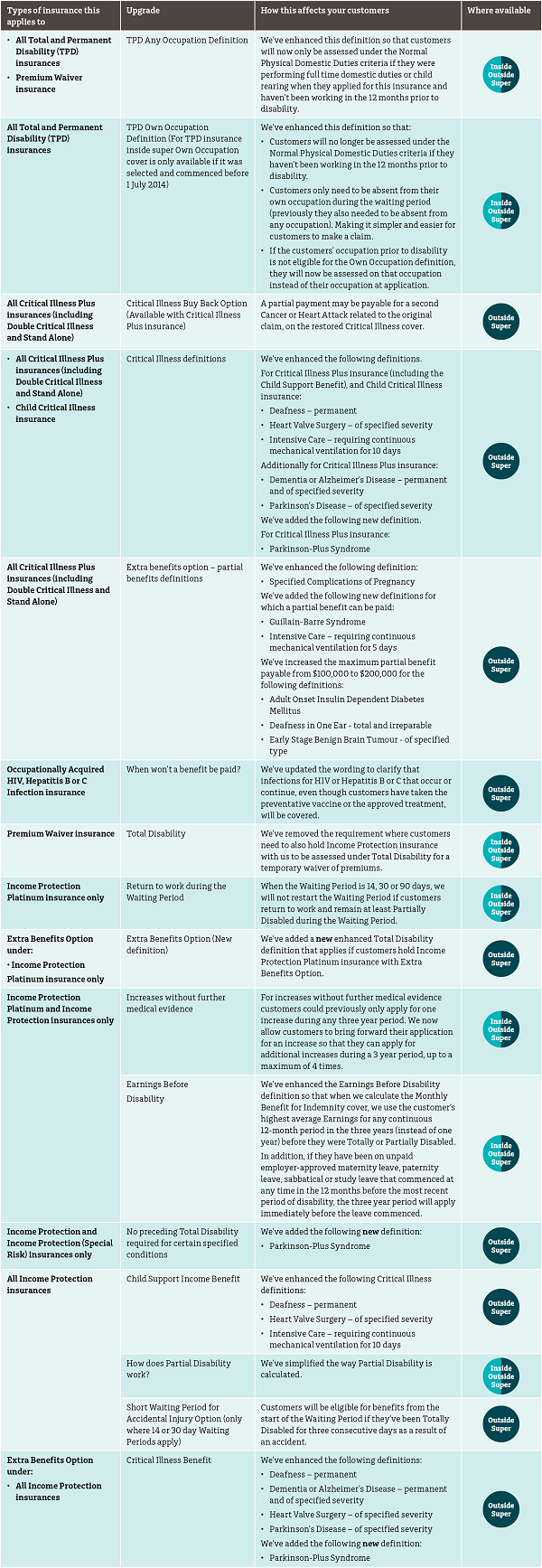

Mlc income protection insurance helps to protect you and your family by paying up to 75 of your earnings if youre unable to work. Our income protection insurance provides a wide range of benefits and additional options to suit your needs. You have the option to also add mlc insurance and mlc masterkey investment protection depending on your needs. National australia bank limited abn 12 004 044 937 afsl 230686.

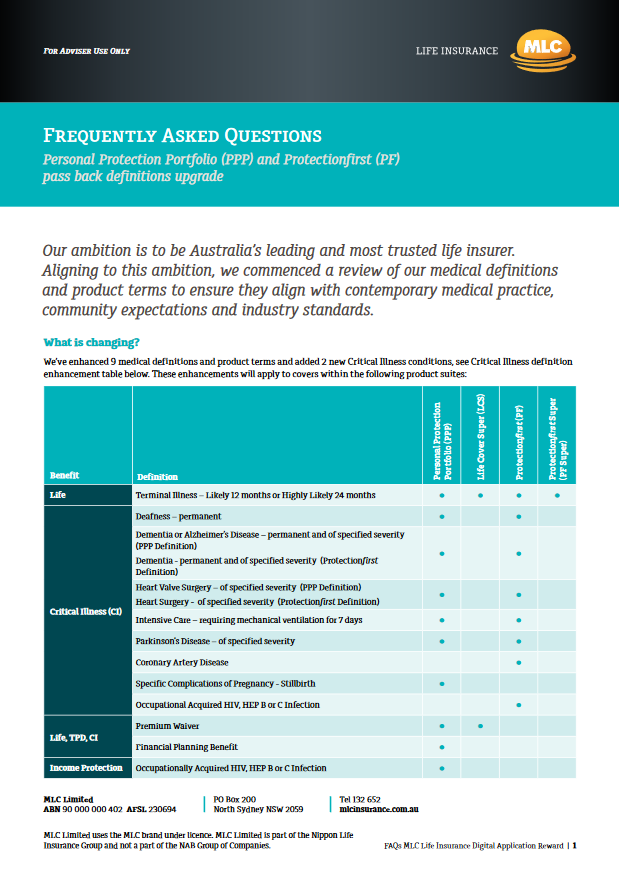

Insurance available when you join. Open a mlc masterkey super fundamentals account sign up now. When you consider our life cover income protection critical illness tpd or business expenses cover you get over 130 years of experience comprehensive life insurance products and dedicated service teams in australia. Speak to a financial adviser and discover what mlc life insurance has to offer.